INVESTOR DIVIDENDS

AND EXIT GUARANTEE

1 . Dividend Distribution

The fund duration is based on a “5 + 3” model. The fund’s main investment period is five years. Once the fund duration reaches 5 years, investors can choose to continue investing for 3 years or complete exit procedures within three years.

Investors in the Hainan Fund of Funds will receive a stipulated annualized rate of return on their investment through quarterly dividends. All fund agreements will be based on an expected annualized rate of return - higher than Chinese government bonds - based on the specific investment vehicle’s forecasted income.

Various fund management fees, service fees, and taxes will be borne by the Sub-Fund Limited Partnership, and paid for by project investment dividends.

2 . Principal Protection and Return Guarantees

- Robust Socio-Political Value in China

- Government Ownership and Management

- Extraordinary Government Support

- Investment Vehicles: Stable Operability and Profitability

- Government-Related Entities or Corporate Groups: Globally Recognized Creditworthiness

- Market-Based Exit Strategy

- Legal Protection of Committed Capital

Robust Socio-Political Value in China

Government-Related Entities (GREs) in China are undergoing a transitional period in which low-quality entities are being eliminated, while high-quality entities are becoming stronger. GK Fund selects GREs and investment projects with the strongest growth trends: ones that provide public services, execute public policy, or develop emerging technologies and industries; ones that will ensure solvency to maintain international creditworthiness, which creates a powerful guarantee in terms of socio-political value.

Public Supervision & Regulation

GK Fund government-related investment projects, relative to other GREs, are under stricter supervision and management of State-owned Assets Supervision and Administration Commissions (SACAC) or state-owned corporate groups, including supervision of expenditure budgets, investments, financing, and mergers or acquisitions.

Extraordinary Government Support

GK Fund government-related investment projects, relative to other GREs, have deeper access to extraordinary government support, which takes the form of liquidity injections, public resource allocations, recapitalization, etc. All government related entities or corporate groups associated with GK Fund are under the management of municipal governments with nationally leading fiscal capacities.

Investment Vehicles: Stable Operability and Profitability

GK Fund government-related investment projects are meticulously assessed to have high growth potential in emerging technologies and industries, or stable revenue streams and predictable returns from commercialized public projects. All investment vehicles are assessed to be capable of maintaining the solvency needed to guarantee investors’ principal and returns upon exiting the fund according to fund agreements.

Equity Repurchase Agreements from Government-Related Entities Backed By Sovereign Credit

GREs directly associated with GK Fund government-related investment projects have achieved a credit rating of AAA in China or an international credit rating of BBB, over 10 billion USD in total assets, and over 10 billion USD in income over the last three years. The Government-Related Entity or corporate group will facilitate investors’ exit via an equity buyback agreement that stipulates a future buyback price that covers investors’ principal and expected returns. The future buyback price will be evaluated and agreed upon prior to investment. The government will hold the Right of First Offer and will execute the buyback on a stipulated date within the fund duration.

Mature Market-Based Exit Strategy:

In the risk event that the equity buyback cannot be executed, the Project Investment Sub-fund has the right to exit via a market mechanism and execute an equity transfer to a third party. To ensure long-term equity market value is capable of covering investor principal and expected returns, the Project Investment Sub-fund’s equity investments into subsidiary investment vehicles will be made at 80% of the equity’s evaluated market price; all subsidiary investment vehicles must meet the minimum criteria of annual equity growth of 6%.

China Company Law: Irrevocable Legal Guarantee

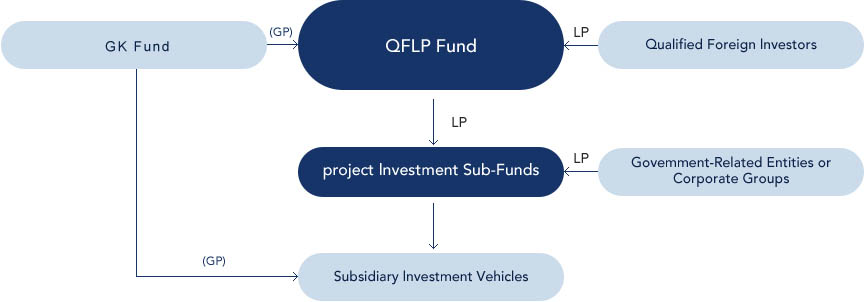

The Limited Partners of the Project Investment Sub-Fund - the QFLP Fund and the Government-Related Entity or corporate group - will each contribute capital to the Sub-Fund.