ALTERNATIVE INVESTMENTS

IN CHINA: A GLOBAL WAVE

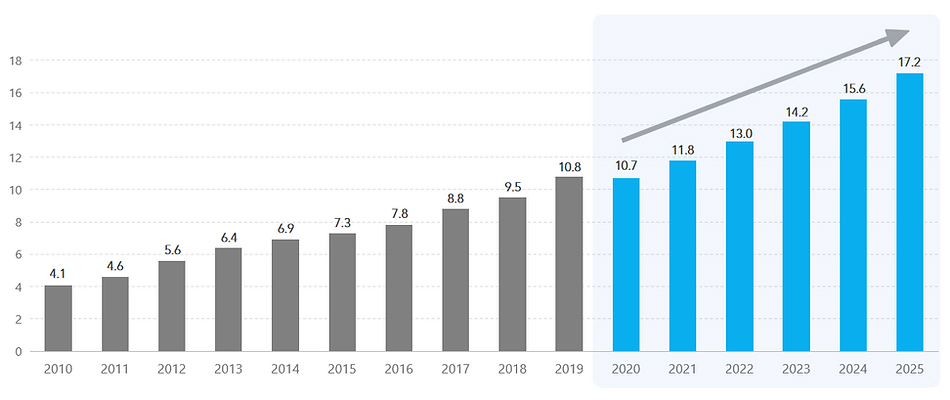

The alternative asset industry has exceeded $7 trillion in recent years, according to Preqin, a global data service platform. Between 2020 and 2025, the total amount of alternative assets under management globally is expected to exceed $17 trillion, reaching an increase of approximately 60%.

ALTERNATIVE ASSETS UNDER MANAGEMENT ($TN)*

* 2020 figure is annualized based on data to October. 2021-2025 are Preqin‘s forecasted figures.

Source: Preqin

ALTERNATIVE INVESTMENTS

Alternative investments, a general term for non-mainstream investment vehicles other than stocks and bonds, are assets that are not publicly listed or managed, including private equity, hedge funds, real estate, commodities, art, etc.

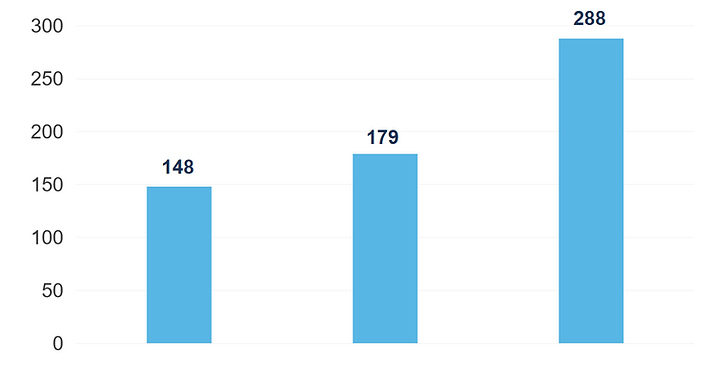

Among all alternative investments, private equity investment is undoubtedly the most significant. In the past two years, global equity investment has continued to hit record highs. According to Crunchbase data, global equity investment reached $148 billion in the first half of 2020 and hit a record high of $179 billion in the second half. In the first half of 2021, global equity investment reached $288 billion, showing an increase of more than $110 billion compared to the second half of previous year, reaching a significant historic high.

- Cate Ambrose

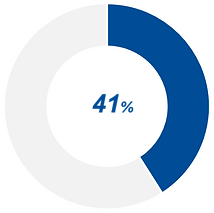

- Speaking at the 2020 Global PE Forum, Cate Ambrose, CEO of the Global Private Capital Association, argued that China has attracted most of the international private equity capital invested in emerging markets in recent years, accounting for 41% of total investments.

- Shen Zhiqun

- At the 2021 China Parent Fund Summit, Mr. Shen Zhiqun, Vice President of China Investment Association and Chairman of the Venture Capital Committee, delivered a speech in which he claimed that China's equity investment industry has matured, having developed comprehensive legal systems, sophisticated markets, and advanced technologies, and has developed into the second largest private equity market in the world with great potential for further development.

- Yang Minghui

- At the CITIC Securities 2022 Annual Capital Market Conference, Yang Minghui, General Manager of CITIC Securities, said that in the past three years, opening up and reform in China’s capital market has been clearly and gradually implemented. Legal protection for global investors is well-developed and comprehensive; the efficiency of investments is very high. A more standardized, multi-level, and efficient capital market, combined with the continued emergence of high-quality enterprises, has made increasing equity investment in China an inevitable choice for domestic and foreign long-term capital.