THE CRITERIA WE ARE HOLDING

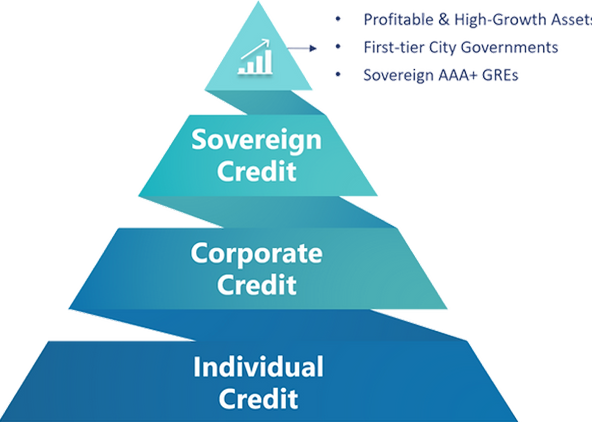

Our team has abundant experience in the field of national development finance in China's domestic markets. Since 2014, We have managed alternative investments with guaranteed returns, via top Government-Related Entities (GREs) with fiscal support from central and provincial level governments in the People’s Republic of China. These Government-Related Entities have Chinese credit ratings of AAA and above, and international credit ratings of BBB and above (Standard&Poor). All of our investments have shown stable, recession-proof growth and have successfully provided our investors with robust and long-term returns. In this alternative investment sector, we are one of the leading and largest fund management firm in China.

- 1) Government Partner Criteria

- Government-Related Entities with fiscal support from the Chinese central government.

- Preferred Government-Related Entities with fiscal support from first-tier governments (provincial governments, centrally-administrated municipal governments, and cities under separate state planning), such as Beijing, Shanghai, Shenzhen, Chongqing, etc.

- Preferred Government-Related Entities with fiscal support from governments of provincial capital cities or cities with a GDP of at least one trillion RMB, including Guangzhou, Suzhou, Chengdu, Hangzhou, Wuhan, Foshan, Dongguan, etc.

- 2) Investment Project Selection Criteria

- AAA or above credit rating in Chinese credit agencies; BBB or above credit rating in international credit agencies.

- Clear and stable revenue sources, quantifiable project investment returns, and able to distribute stipulated dividends; able to provide investors with guaranteed fixed-income returns appropriately.

- Possesses essential public and industrial resources, with reliable access to extraordinary fiscal and government support in China.

- Access to stable and multi-channel financial resources with strong liquidity risk management ability.

- Subject to external supervision and regulation, with industry-standard management structures for operations, budgeting, and investing.

- 3) Fund Investment Key Information

- Investment vehicles can provide fixed dividends based on expected net project income throughout the duration of the fund agreement.

- Investment duration: 5+3 Years. After the fund duration reaches 5 years, investors can decide to exit the fund or continue investing for another 3 years.

- Investors enter the fund as Limited Partners within a Qualified Foreign Limited Investor fund within the Hainan Free Trade Port for convenience of investment and tax incentives.

- Investor returns and principal will be denominated and settled in USD.

LEGAL PROTECTION FOR GLOBAL

INVESTORS IN CHINA

Legal System for QFLP (Qualified Foreign Limited Partnership) Investments Established in 15 Regions

A total of 15 regions in China (including Beijing, Shanghai, Tianjin, Chongqing, Guangzhou, Shenzhen, Qingdao, Zhuhai, Xiamen, Guizhou, Guangxi Pilot Free

Trade Zone, Suzhou Industrial Park, Pingtan, Hainan, and Xiong'an New Area) have issued policy statements and regulatory documents related to QFLP investments.

At the national level, policy documents related to QFLP include the Company Law of the PRC, Partnership Enterprise Law of the PRC, Special Administrative

Measures (Negative List) for Foreign Investment Access, Foreign Investment Law of the PRC, Interim Measures for the Supervision and Administration of Private Investment Funds, Notice by the State Administration of Foreign Exchange of Further Facilitating Cross-border Trade and Investment (28 [2019] of the State Administration of Foreign Exchange), Opinions of State Council on Further Effectively Using Foreign Investment (23 [2019] of the State Council) and other taxation related policy documents.

The Notice by the State Administration of Foreign Exchange of Further Facilitating Cross-border Trade and Investment (28 [2019] of the State Administration of Foreign Exchange) published by the State Administration of Foreign Exchange specifies that in accordance with relevant laws and regulations, investment-oriented and non-investment foreign-funded enterprises (including foreign-funded companies, foreign-funded venture capital enterprises, and foreign-invested equity investment enterprises) are allowed to carry out investments in China’s domestic equity markets.

- Opinions of the State Council on Further Effectively Using Foreign Investment

View More

- State Administration of Foreign Exchange: Reforming and Standardizing Foreign Exchange Settlement

View More