GK is a China based Assets Management Company which is focusing on Alternative Investments Funds(AIF). Our business is mainly about Private Equity(PE), Real Estate Fund, Mezzanine Fund, Closed End Fund and Finance Consulting including M&A(Merge and Acquisition), Business Re-structuring and Fundraising.

With the development of China economy, the capital requirements are becoming critically important for the enterprises to enhance their comprehensive competitiveness and balance the re-structuring and re-shaping to meet the new era which is being driven up by informatization.

GK manages variety of funds which invest in China prospective assets and entities, and overseas potentially developing companies as well. We make fundraising from Qualified Foreign Institution Investors(QFII) world wide and Domestic Qualified Institution Investors(QDII), and Private Investors.

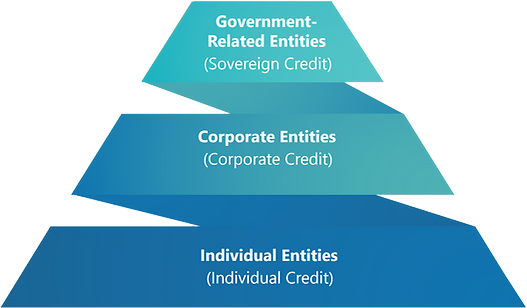

Our team is undertaking their commitments very firmly in China capital markets. The AUM(Assets Under Management) is more than 20Billion RMB (3.5B USD) being executed by us. Our clients are mainly institutional investors, Government Related Entities(GRE) and reliable investors. We are maintaining the highest standards of integrity involves faithfully meeting our commitments to all our constituents – customers, communities, employees, the Board, shareholders, regulators – and to ourselves.

We will work with fierce resolve to make this a company of which our customers, employees, shareholders and communities can be proud. We cannot promise specific outcomes or risk-free results. From time to time, we may fall short in our efforts and if that happens, we will renew our commitment to these principles and re-double our efforts. What we can and will promise is to be truthful and give honest assessments of our businesses and prospects; act with integrity and honor; and do the right thing—not necessarily the easy or expedient thing.

Our job is to always do right by them and consistently strive not only to meet their needs but also to exceed their expectations and continually make it easy for clients to do business with us. As important as strategy is, we have to execute to be successful. Execution involves every employee and every contact we have with customers. We must act quickly on problems; drive results, not just activities; and ensure detailed follow-up so that we meet our commitments.

Eventually, it all comes down to people. Creating a winning team and self-sustaining culture takes hard work, and there is no substitute for it. Teams do not win because they have a new stadium or the most attractive uniforms. Some of the best teams do not even have the most talented individual athletes. Teams succeed because they are disciplined, work well together, execute consistently and have a passion to win.